Creating a Financial Plan

Retirement Planning Series: Part 2

Last time, we discussed investment opportunities that help get you on track towards retirement savings. Let’s shift our focus now to what happens when you retire.

In retirement, there’s a significant shift from saving money and experiencing compound growth to spending this money and potentially watching the balance decrease.

So as you prepare for the big day, you may wonder whether the money you’ve saved is enough for your lifestyle. Although there is no definite answer to this, here are some ideas that may reduce some of your anxiety or stress.

As you plan for retirement, there are four things that you need to think about:

The money you’ve saved

How long do you expect to live

How much money do you think you will need

Protecting your income needs

1. Savings

Probably the most obvious point. The more money you save, the more you'll have when you choose to retire. The sooner you can begin to save and the more you can save, in theory, the more comfortable your retirement will be. The balance between how much to spend today and how much to save for tomorrow is a very personal decision and without a rule of thumb.

2. Longevity

As life expectancy has been steadily increasing, over-estimating your life expectancy assumption in your retirement plan is advisable.

This Guide to Retirement finds that couples aged 65 have a 90% chance of living to 80 years or longer. Therefore, if you’ve reached 65 (and are presumably in good health), you should be aware that your savings will likely need to last another 20 to 30 years.

3. Income Needs

How much you will need for your retirement plan will be based on several factors that play into your lifestyle, such as family size, health, travel, home ownership, etc.

Inflation is a hot topic and a crucial factor in anyone's plan. Regardless of your planned retirement lifestyle, the costs of everyday items are increasing, meaning that your dollar is not going as far as it used to.

Think about this:

In 1985 a cup of coffee cost $2.50.

Let’s say you had the option to either buy that coffee or invest the money in a 20-year Canadian government bond yielding 0.9%. Bonds are often viewed as a source of income in retirement portfolios, so let’s say you used the income generated by the bond to pay for some expenses rather than reinvesting it.

How many cups of coffee could you buy today (2022), assuming an inflation rate of 2.5%?

The quick answer is; not enough to buy a single coffee anymore. In fact, you would have enough money for roughly 85% of a cup of coffee.

By the way, the real inflation rate for coffee between 1985 and 2022? About 2% per year, far beyond the bond returns. And for the next question, why coffee? Because it’s such an integral part of daily life that it would be challenging for people to change their consumption habits drastically.

This is why it's essential to consider your income needs over the years and the value of your money that will change yearly due to inflation.

4. Protecting Your Income

With the above points in mind, the big question remains: How can your retirement savings keep up with the increase in costs every year? Choosing suitable investments is crucial.

Let’s consider this scenario:

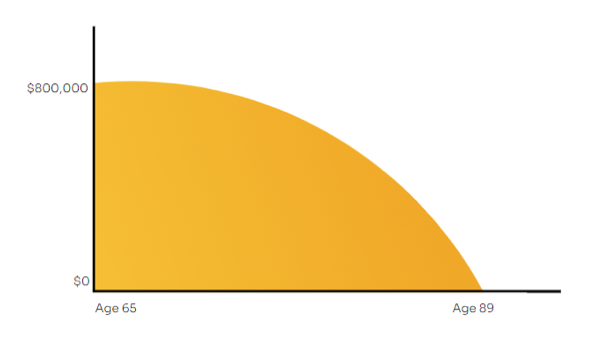

Jennifer is 65 years old and planning for a 30-year retirement. She has saved nearly $800,000 and expects to need the equivalent of $40,000 per year. With a 4% rate of return, what will her retirement savings look like assuming 2.5% inflation?

If she invests her retirement income in “safe” investments - low-risk, but generating low returns (4%) - Jennifer will run out of money by age 89, when you factor in inflation. The low rate of return is being outpaced by the effects of inflation on Jennifer’s financial needs.

By contrast, Jennifer could invest in a mixed portfolio of "safe" investments and ones that present opportunities for longer-term returns at a higher rate (assume a combined rate of return of 6.6%). In this case, her financial outcome looks quite different. This portfolio, still assuming 2.5% inflation, funds her retirement comfortably and leaves her with a significant amount of money in her account at age 95.

The above scenarios are hypothetical investors used to illustrate the effect of investing in different vehicles. The results don’t represent actual returns of an investible portfolio

'Safe' always feels better, especially regarding your retirement savings; however, it may lock you into portfolio returns that will not provide you with the lifestyle you desire. Constructing the portfolio that best fits your comfort of volatility and your need for growth is one of the many ways an advisor can help.

The Importance of Productive Assets

Your portfolio could include "productive assets" that generate the growth and the rising income you need in retirement. These assets could be a great business, a farm or a real estate investment, to name a few.

Productive assets allow your savings to grow faster than inflation. Businesses can raise costs over time, expand into new markets, or launch new products. If you own the stock of a great company, the rising income will come in the form of appreciation in the value of the share price over time and from rising dividend payments.

No “one-size-fits-all”

Ultimately, there is no magic formula for building a successful retirement plan. But some professionals are willing to work through forecasting, calculators, estimations etc., to find a retirement plan that fits your lifestyle, is realistic, holistic and has a high probability of success. If this style of planning is relevant to your family and you currently are not working with this type of advisor, we would encourage you to begin your search. See our article '10 Questions to Ask Your Financial Advisor'; it may put you on the right track.

John Cruise is a Portfolio Manager registered with Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (IIROC.ca) and is a Canadian Investor Protection Fund (CIPF.ca) member. Investment products are provided by ACPI and include but are not limited to mutual funds, stocks, and bonds.

John Cruise is registered to provide investment advice and products to clients residing in the provinces of Ontario, Nova Scotia, Quebec and Alberta. Any advice given in respect of non-securities services is given by John Cruise solely, and no such advice is given in their capacity as a registrant of ACPI.

Canadian Investor Protection Fund (CIPF) coverage is available to IIROC Dealer Members and does not offer protection, within limits, on non-securities products not held by a Member. Non-securities-related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any insurance product; any mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above-noted activities. You should not rely on ACPI to review any non-securities services provided by John Cruise.

This website is for informational and reference purposes only and is not intended to provide specific personalized advice, including, without limitation, investment, financial, legal, accounting or tax advice. Please consult the appropriate professional depending on your circumstances. This website does not constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.