The Sequence of Returns

Retirement Planning Series: Part 4

Besides health, financial security in retirement is one of the most serious concerns for most people. With longer life expectancy and the current high inflation rate, the most significant risk is outliving your money.

Once you begin retirement, the accumulation phase of your investments ends, and you start regular withdrawals. How and when you make these withdrawals is essential when considering the longevity of your investment portfolio.

Your needs may initially be steady during retirement, but expenses often increase as you age, for example, if you need additional health support or caregiving. As we’ve demonstrated in Part 2 of this series with our cup of coffee example, inflation eats away at the purchasing power of your money.

One way to mitigate this risk is to evaluate your sequence-of-returns risk, the risk that the market will decline in the early stage of your retirement, which, paired with your ongoing withdrawals, might significantly impact the longevity of your portfolio.

If you withdraw money when the market is down, you are potentially selling your investments at a loss and need to sell more to generate enough money for your expenses. With less in your portfolio, you have less ability to take advantage of compounding growth as the markets recover.

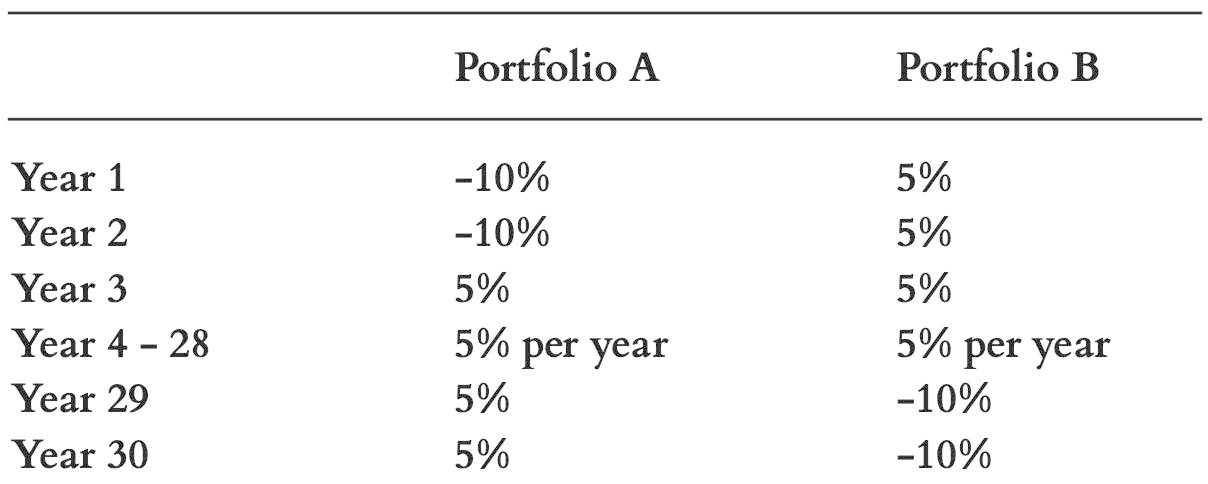

Here are two scenarios:

In each case, the retiree starts with $1,000,000 at age 65 and withdraws $40,000/year for 30 years. Their returns are exactly the same but in reverse order.

Portfolio A has -10% returns in the first two years but 5% each year afterwards. Portfolio B sees a 5% return until years 29 and 30, when they experience -10% returns.

Collectively, they have the same rate of return, but because Portfolio A lost value early in retirement, the retiree lost out on compounding interest in their portfolio and doesn’t even make it to year 30. Portfolio A runs out of money by year 25. Portfolio B, however, still has over $500,000 left at year 30.

Since you have no control over the markets, how can you protect your portfolio from this sequence of returns risk?

The Value of Your Advisor

Your advisor is your secret weapon here. They can create a plan for your retirement withdrawals to manage your sequence of returns risk by looking at your individual needs and allocating your investment savings to cover your short-term and long-term needs.

Money to cover your short-term needs could be invested in cash, high-interest savings funds or short-term GIC's for example, protecting against market losses. Money to cover long-term needs could be invested in equities to ride out any downturns over time and take advantage of compound growth as markets recover.

If the advisor for Portfolio A had set up a short-term cash strategy for the first 5 years, the retiree wouldn’t have been affected as badly by the poor returns in the first 2 years, and their portfolio could have lasted until year 30, with funds left over.

A sequence-of-returns risk is significant in the early years of retirement. Once you get to the 5 - 10 year mark with a good sequence of returns, the risk drops significantly. Regular meetings with your advisor throughout your retirement will help you continue to reduce your risk and enjoy a comfortable retirement.

John Cruise is a Portfolio Manager registered with Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (IIROC.ca) and is a Canadian Investor Protection Fund (CIPF.ca) member. Investment products are provided by ACPI and include but are not limited to mutual funds, stocks, and bonds.

John Cruise is registered to provide investment advice and products to clients residing in the provinces of Ontario, Nova Scotia, Quebec and Alberta. Any advice given in respect of non-securities services is given by John Cruise solely, and no such advice is given in their capacity as a registrant of ACPI.

Canadian Investor Protection Fund (CIPF) coverage is available to IIROC Dealer Members and does not offer protection, within limits, on non-securities products not held by a Member. Non-securities-related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any insurance product; any mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above-noted activities. You should not rely on ACPI to review any non-securities services provided by John Cruise.

This website is for informational and reference purposes only and is not intended to provide specific personalized advice, including, without limitation, investment, financial, legal, accounting or tax advice. Please consult the appropriate professional depending on your circumstances. This website does not constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.